/36/

Market

Trends and

Insights

The Israeli capital market is a developed and supervisedmarket,with one stock exchange

– the Tel Aviv Stock Exchange.

Special Characteristics of Offerings in Israel

The main characteristics of offerings in Israel are bonds offerings, the ability to issue

participation units in partnerships engaged in the oil, gas and film industries and the

existence of a dual listing arrangement.

Bonds Offerings

In recent years, most of the securities offering in Israel have been bonds offerings.

While in other countries, bonds are usually traded over-the-counter (“OTC”), in Israel

they are traded on the stock exchange. The bond offerings were mainly made by real

estate companies, with a secondary trend being the offering of bonds of American real

estate companies; and by banks. By way of example, we represented Bank Leumi in the

publication of a shelf prospectus and in a public offering of bonds in the total sum of

US$ 753 million in 2015.

Of all the bond offerings carried out in 2014, approximately US$ 5.55 billion were

listed for trading on TACT Institutional, of which approximately US$ 3.44 billion were

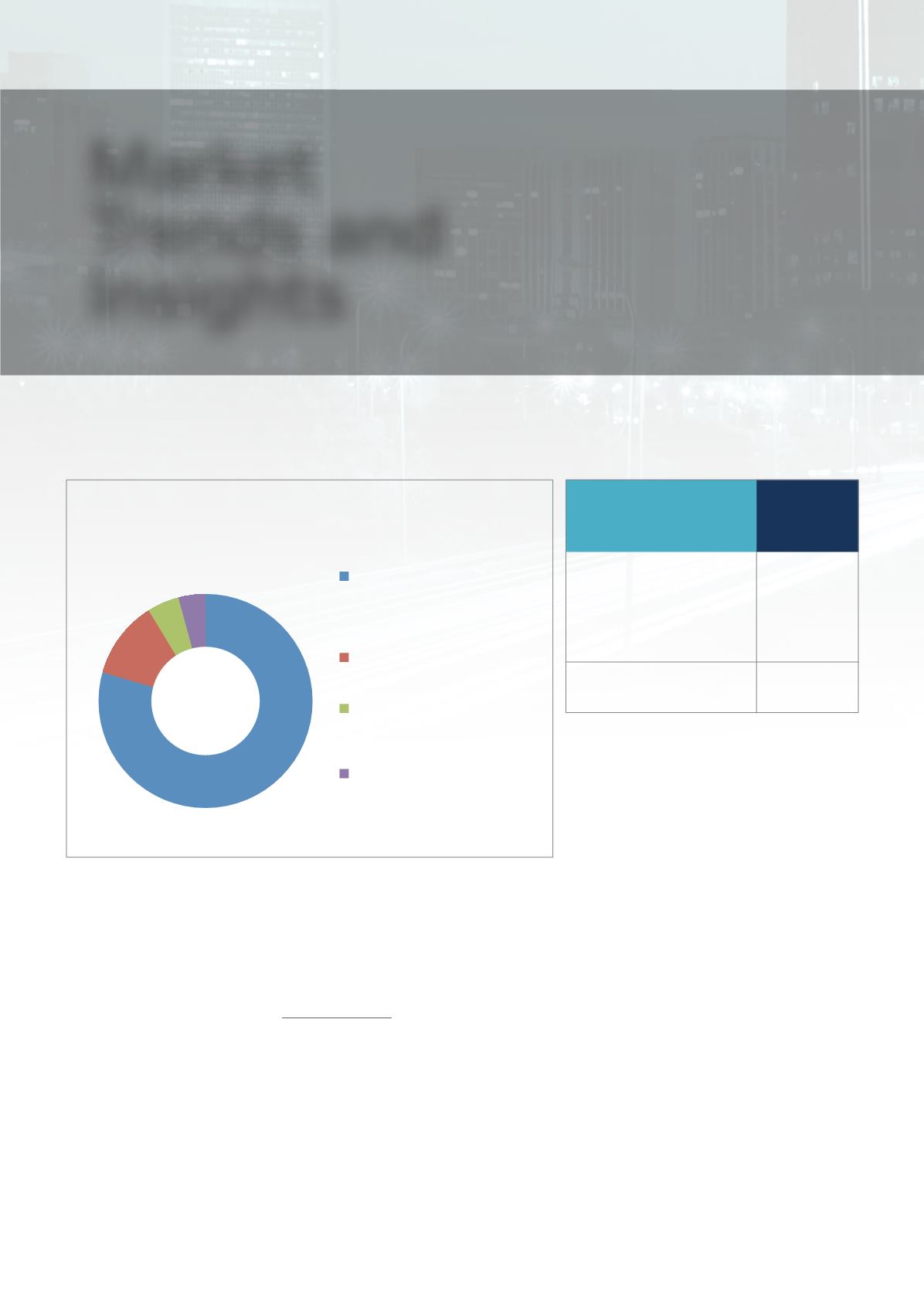

At the end of June 2015' 588 corporations

(companies and partnerships) were traded on

the Tel Aviv Stock Exchange

Corporations that had issued

shres, shares and bonds, or

participation units in partnership

to the public

Campanies that had issued bonds

only

Campanies that had issued ETFs'

currency ETFs and structured

bonds

69

28

24

467

Campanies are traded on TACT

(Tel Aviv Continuous Trading)

Institutional listing (a system for

trading between institutional

entities only)

Market Value

July 2015

(US$ Billions)

Shares and

238

Convertible securities

(not including

TACT Institutional)

Bonds

216