/44/

Israel High-Tech

& Venture Capital

Overview – 2014

The following articles contains excerpts from the full High-Tech and Venture Capital

Research Overview for 2014, first published in the IVC High-Tech 2015 Yearbook

published in April 2015. The full Research Overview is also available as a PDF report file

or a brief presentation from IVC.

Israeli High-Tech Capital Raising

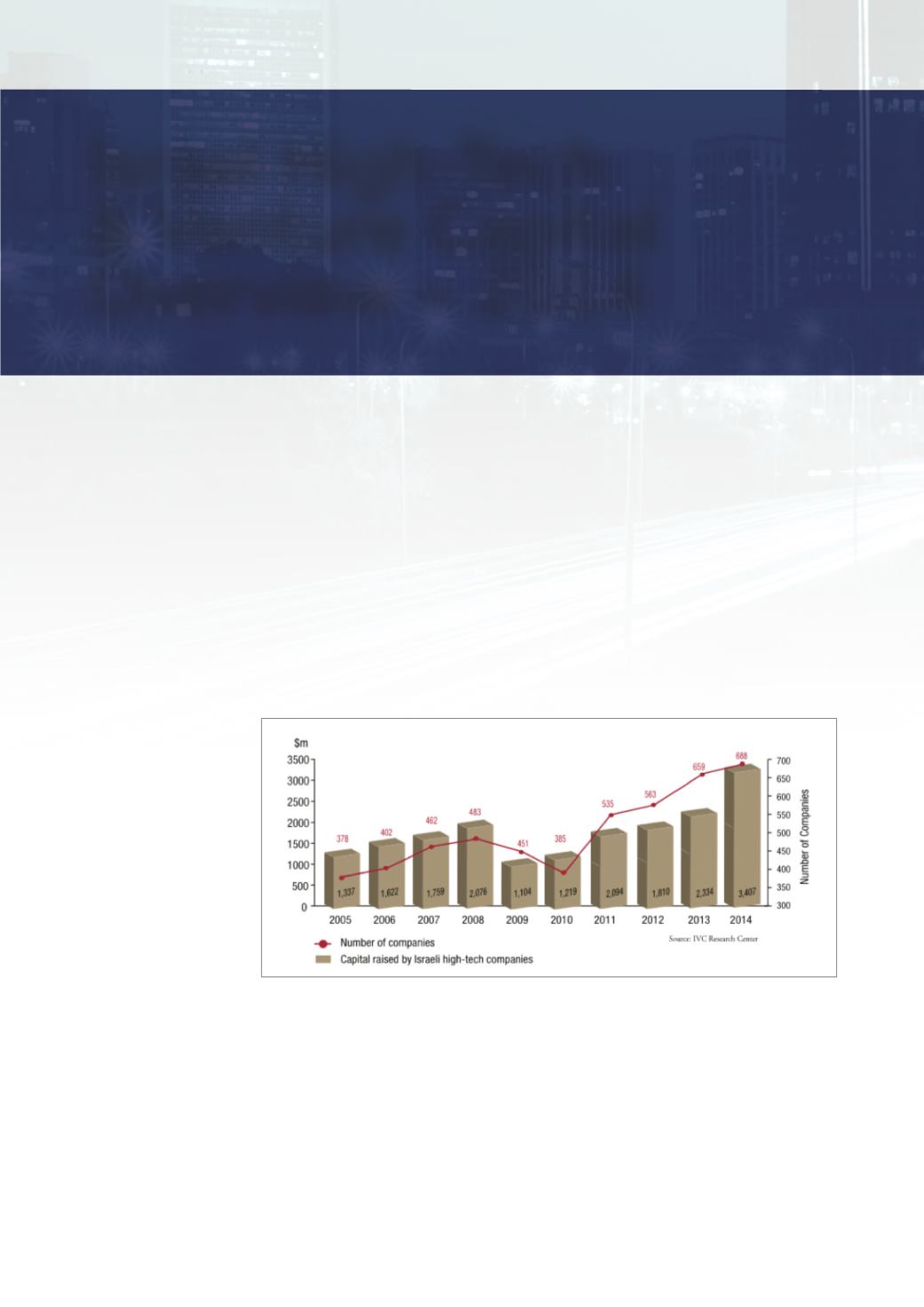

In 2014, Israeli high-tech capital raising set an all-time record as 688 companies

attracted $3.4 billion. The amount was up 46 percent from $2.3 billion raised by 659

companies in 2013, and 88 percent above $1.8 billion invested in 563 companies in

2012. The average company financing round in 2014 was $5.0million, compared to $3.5

million in 2013 and $3.2 million in 2012.

Chart 1.1: Total Capital Raised by Israeli High-Tech Companies 2005-2014

An analysis of high-tech capital raising by sector shows, 169 Internet companies raised

$941 million in 2014, the most of any sector and 28 percent of the total raised by all

sectors. The amount was exceptionally high for the sector, even surpassing the $927

million registered in 2000. It exceeded 2013’s $515 million raised by 184 companies by

83 percent, and was up almost 150 percent from $382 million raised by 146 Internet

companies in 2012. The average fnancing round was $5.6 million.

The life sciences sector followed as a record high 167 firms attracted $801 million,

which accounted for 24 percent of the total raised. The amount – also a record –was 55

percent above the $516 million (22 percent) raised by 142 life sciences companies in

2013, when the sector led all investments, and 64 percent higher than the $489 million

(27 percent) invested in 133 companies in 2012, when the sector was also the most

popular among investors.