/46/

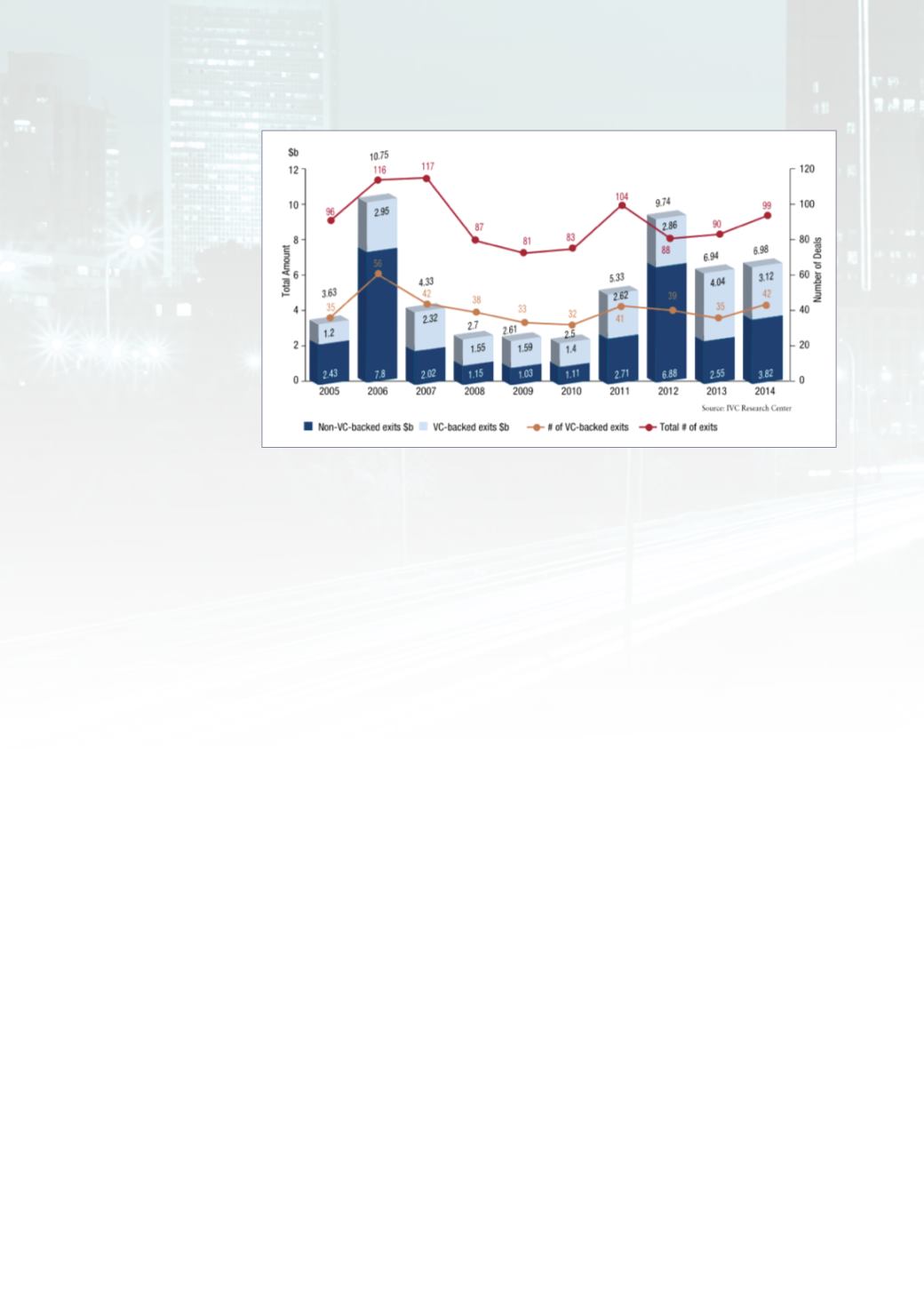

Chart 3.4.1: Total Exits vs VC-Backed Exits 2005-2014

Mergers & acquisitions

In 2014, M&A deals involving Israeli and Israel-related companies that were acquired or

merged were valued at $4.84 billion, a 22 percent decrease from $6.23 billion in 2013.

The average M&A deal in 2014 was $59 million, compared to $76 million in 2013. Four

deals exceeded $300 million, with 17 M&A deals worth $100 million or more. Analysis

of M&As by deal size reveals a 45 percent increase in the number of deals ranging from

$100 million to $500 million in 2014. Sixteen such M&A deals accounted for $2.91

billion, compared to 11 deals in 2013 worth $2.57 billion. Five deals ranging between

$50million and $100million were valued at $425million, a 73 percent increase from four

deals in 2013 that totaled $246 million. The number of M&As ranging from $10 million

to $50 million also increased – approximately 13 percent from the previous year.

Changes in deal size appear to be responsible for two contrasting

trends.Onone hand,

the averageM&Adeal in 2014 decreased to $59million from$62million in 2013 in deals

below $1 billion. On the other hand, in 2014 there was a notable jump in the M&A return

on equity ratio, reaching an average of 6.22 from 4.29 in 2013. The calculation is made

as a ratio between capital from M&A exits and the total capital raised by companies

prior to their exit. The measure relfects the relative value received by company investors

following a company’s exit.

Nine of the 10 largest exit deals in 2014 were acquisitions, accounting for 43 percent

of total proceeds in high- tech exits. The Viber and Check deals, acquired by Rakuten

and Intuit, respectively, accounted for nearly 90 percent of communications exit

proceeds. Te Kontera, Aorato, Cyvera and SuperDerivatives deals accounted for almost

50 percent of IT & enterprise software sector proceeds. In 2014, seven of the 10 largest

acquisitions involved venture-backed frms.

Public Offerings

In terms of the number of public offerings, 2014 was the most active year for Israeli

high-tech IPOs since 2007. A total of $2.1 billion was raised by 17 Israeli companies on

NASDAQ, the NYSE, AIM and the London Stock Exchange. MobilEye, the largest IPO of

2014, raised slightly over $1 billion on the NYSE. Each of the remaining 16 IPOs raised

less than $150 million, including the second largest IPO in 2014 which was completed

by SafeCharge on London’s AIM. The year saw a particularly strong return of Israeli high-

tech companies to NASDAQ with 11 IPOs completed.