/45/

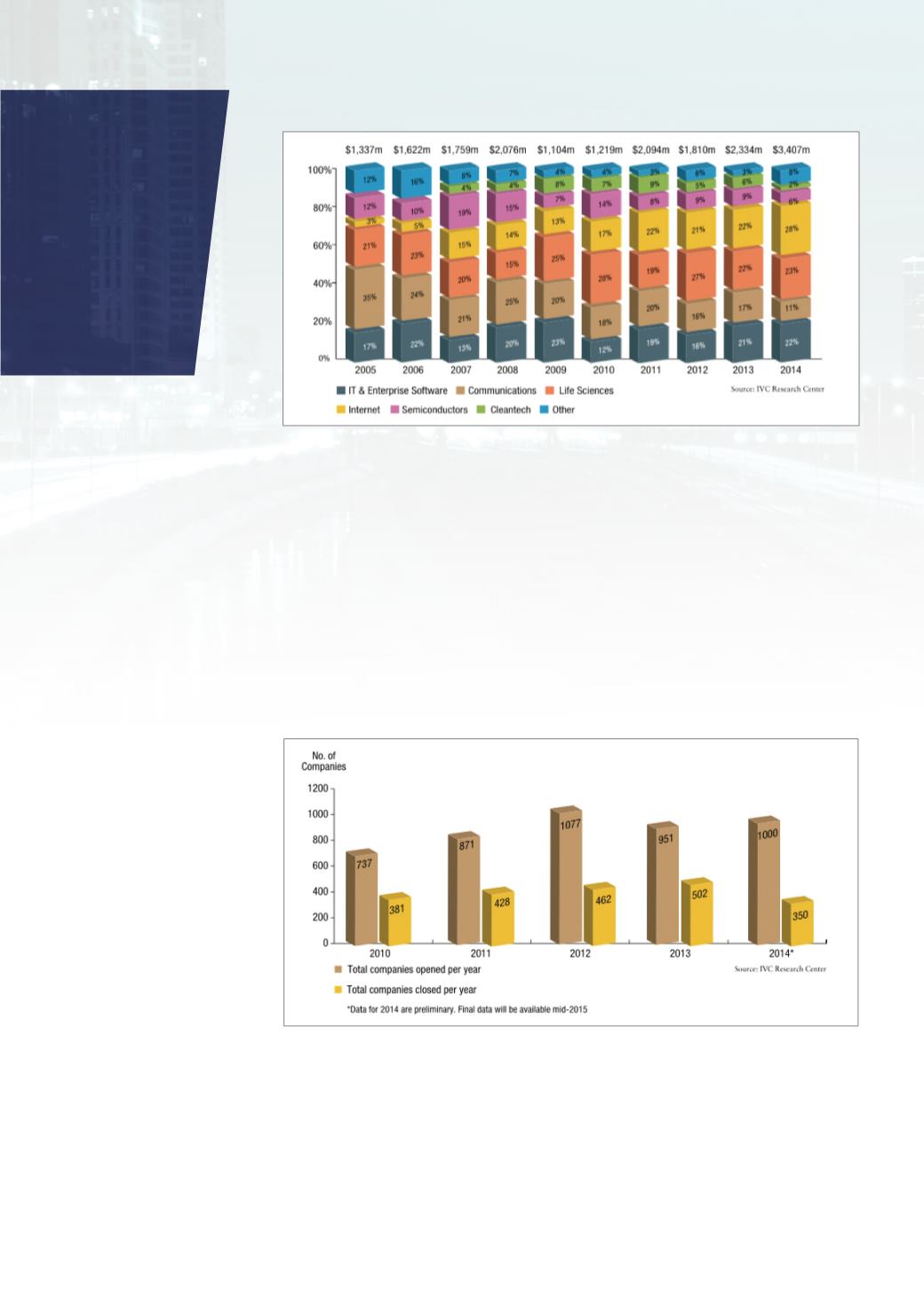

Chart 1.2: Capital Raised by Israeli High-Tech Companies by Sector 2005-2014

Israeli High-Tech Startups: Opened vs. Ceased

High-tech company formations increased 5 percent to 1,000 in 2014. The Internet

sector saw heightened activity with 368 company formations that accounted for 37

percent of total openings. The rise in openings, particularly in the Internet and mobile

application sectors, refects the fact that it is now faster and cheaper to establish new

startups, which have short time-to-market.

After years of a stable ratiobetween new formations and closings,with two companies

newly formed for every company closed, 2014 saw the ratio move to three companies

established for every closing. This indicates that companies today, in sectors such as

the Internet and mobile apps, have more robust business models and can be easily

sustained while receiving less investment.

Chart 2.1: Newly Established vs. Closed Israeli High-Tech Companies 2010-2014

Israeli High-Tech Exits

This section examines mergers and acquisitions (M&As) and initial public oferings (IPOs)

of Israeli high-tech companies, based on the IVC-Meitar Exits Report.

In 2014, 42 VC-backed exits were valued at $3.1 billion, accounting for 45 percent

of the $6.94 billion from 99 exit deals involving Israeli and Israel-related high-tech

companies. The year 2014 was not as strong as 2013 for VC-backed exits despite more

deals taking place, with proceeds 23 percent lower. Proceeds from 2014 exits were 31

percent higher, however, than the 10-year $2.36 billion average.