/47/

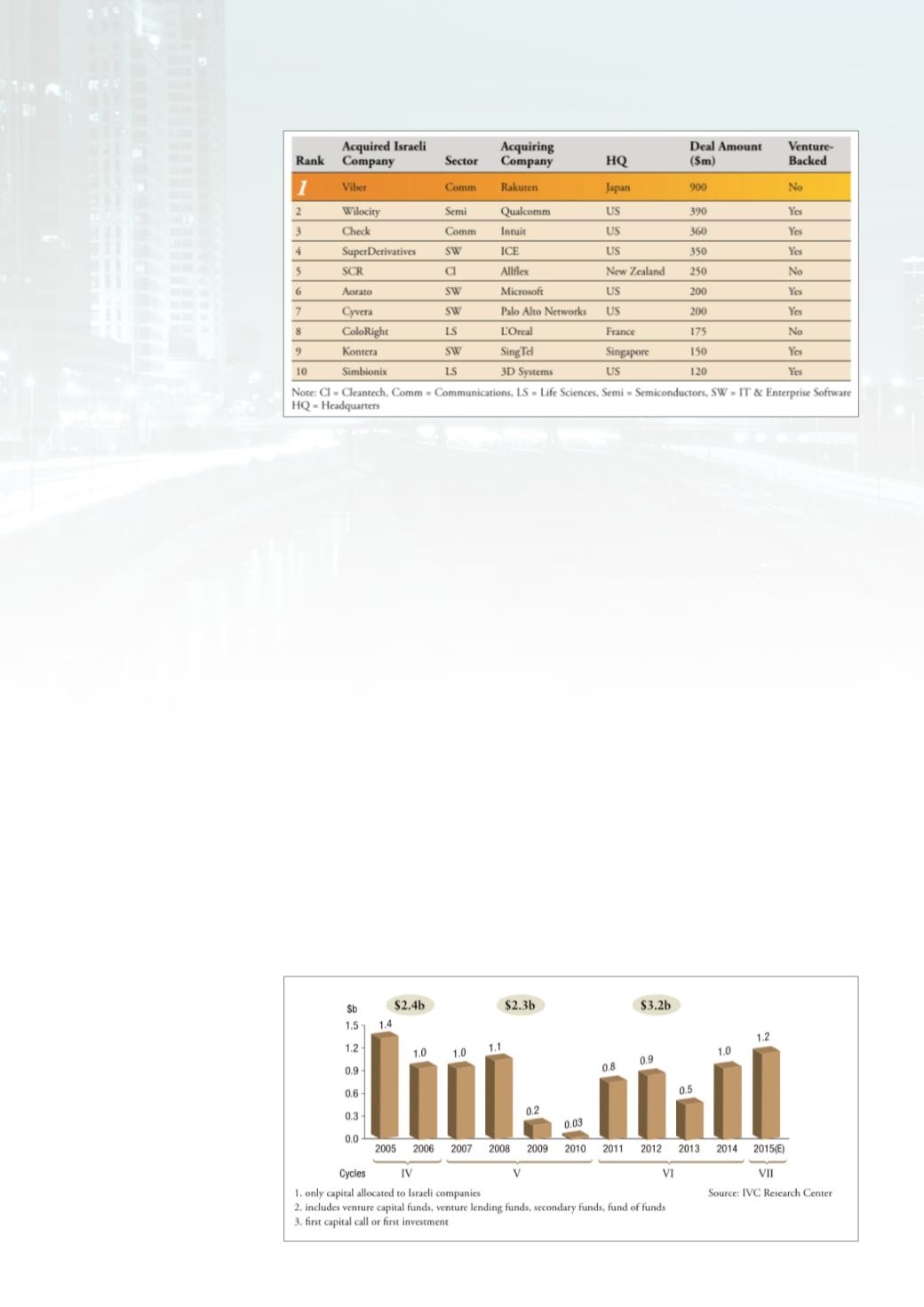

Israeli Venture Capital Fund Raising

The growth of Israel’s venture capital industry is traced to six cycles of fund raising

that peaked in 2000 with $2.9 billion raised, and declined continually through 2003

when only $64 million was raised. In 2014 the Sixth cycle ended on a high note with

$996 million capital raised. In the four cycles since 2000, Israeli venture capital funds

attracted a total of $13.3 billion.

The year 2014 was the most successful year since 2008 in terms of Israeli venture

capital fund raising. Thirteen funds raised $996 million, 45 percent above the $544

million raised by 11 Israeli VC funds in 2013 and 20 percent more than the 10-year

average of $795 million. More medium sized funds and fewer micro VC funds were

raised in 2014 than in the two prior years. The average fund size rose to $77 million, just

short of the $78 million 10-year average.

Five funds raised more than $100 million in 2014: Carmel Ventures’ fourth fund

attracted $194 million. Magma raised $150 million for its fourth fund, which was to

start investing in 2015, less than two years after closing its previous $110 million fund.

Singulariteam, managed by Moshe Hogeg and Kenges Rakishev, raised $102 million for

its second fund. JVP made a first closing of $160 million of a targeted $180 million

for its seventh fund with two components – JVP VII and JVP VII Cyber. In addition,

Vintage’s seventh fund, a fund of funds, attracted $144 million, 50 percent of which is

allocated to Israeli funds. The above five funds accounted for 68 percent of total capital

raised for investments in Israeli companies in 2014. In 2013, Vintage and Aleph each

raised over $100 million and accounted for 57 percent of total capital raised.

Chart 2.1.2: Capital Raised¹ by Israeli VC Funds2 2005-2015(E) by Vintage Year3 & Cycle

Table 3.1: Top 10Merger & Acquisition Deals Involving Israeli High-Tech Companies 2014